Table of Content

Being underinsured means your homeowners insurance policy won’t pay enough to rebuild, repair or replace your assets in the event of an unexpected disaster. Renter’s insurance is property insurance that covers a policyholder’s belongings, liability, and possibly living expenses in case of a loss event. The good news is that you can fine-tune your homeowners insurance policy to make sure you have the right type—and right amount—of coverage. This process will help you choose the right personal property coverage limit and can pay off if you need to file a claim. An inventory will clearly show what you had before a disaster and make the claims process easier.

Personal liability coverage limit if you’re adding a swimming pool; the chance of injury or drowning in your pool could make you a potential target for lawsuits. Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more. Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you'll be directed to your state's health insurance marketplace website.

What Options Are Available With Homeowners Insurance Policies?

The Cigna name, logo, and other Cigna marks are owned by Cigna Intellectual Property, Inc. This means that if you had a claim that falls under your dwelling coverage, your insurer would pay up to $200,000 after you pay your claim deductible. You would pay for anything beyond that limit out of pocket. Similarly, if you had a claim that falls under your liability coverage, your insurer would pay up to $100,000, and you would be responsible for anything that exceeds that amount.

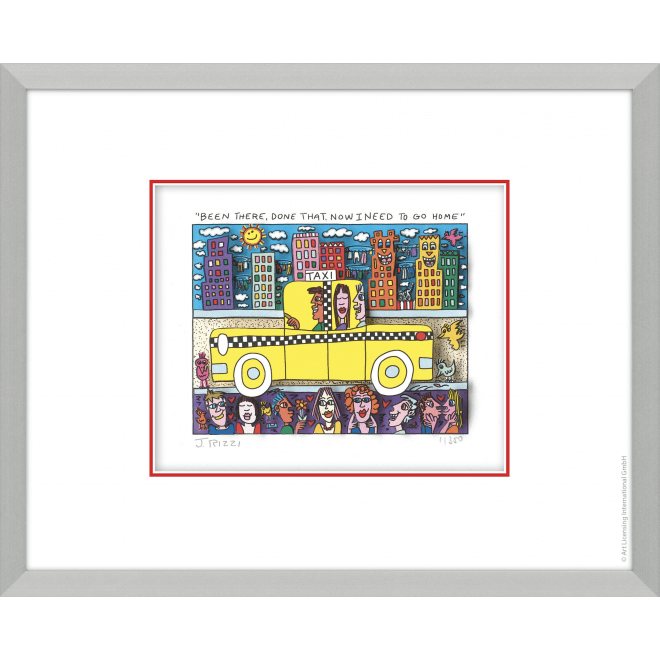

She covers topics such as stock investing, budgeting, loans, and insurance, among others. One thing to note is that homeowners insurance doesn’t cover all of your belongings. If you have high-value items like jewelry, art, and/or electronics, you might need a rider policy to cover those items. While it’s not legally required, where you’ll find that homeowners insurance is required is when you try to get a mortgage. It is rare to find a lender who is willing to approve you for a mortgage without making homeowners insurance a stipulation in your contract. This is because when you take out a mortgage to buy a house, you and that lender are essentially going into the venture together.

Why Do I Need a Homeowners Insurance Policy?

For example, if you typically spend about $300 a week feeding your family, your loss of use coverage would likely not cover meals and food that exceed that amount each week. Raising the amount you have to pay before your insurance company provides coverage can save you money on your premium. Determine what qualifies as other structures on your property based on your insurance policy, then determine how much it would cost to rebuild each of your qualifying structures. Unlike liability coverage, you don’t have to be deemed responsible for the injury in order to use this coverage. So, if a friend chips a tooth after slipping down your stairs, you can use medical payments coverage as a courtesy to help your friend with dental care. Medical payment coverage may even serve as a buffer to prevent being taken to court.

The inventory you store in your home is damaged and your homeowner’s policy won’t cover the cost to replace it. Yourstate social service agency can help you locate medical and health programs. Preferred provider organizations offer lower co-payments like HMOs but give you more options when selecting a provider. If you need help appealing a dispute with your insurance company, contact the Marketplace Call Center.

What Does Homeowners Insurance Cover?

Different insurance companies include varying perils in their standard packages. More often than not, fire, windstorms, hail, lightning, and vandalism are some of the most common perils that are added to the standard package. This, of course, could vary depending on the location, state, and ZIP code of your mobile home. While most insurers allow you to decrease this percentage, they usually won’t let you increase this type of s coverage. Typically, in order to increase the coverage amount for other structures, you will have to also increase your dwelling insurance. If you’re found legally responsible for bodily injury or property damage to another person, your assets may be at risk if the claim exceeds your coverage.

Umbrella insurance gives you extra protection from accidents and lawsuits. If you injure someone or damage their property, you might not have enough coverage. An umbrella policy could save you from paying out of your own pocket. If you rent an apartment, condo, house, etc., you need renters insurance. Get a renters insurance quote today and we'll show you how easy and affordable it is to protect what you care about.

It is practical and comprehensive, and offers solutions through the tough times of loss or damage when the pockets aren’t as full. Enroll today and your coverage can start as soon as next month. All other policyholders, regardless of zone, must carry flood insurance by 2027.

Protecting your home-based business from claims of bodily injury, property damage, or even lawsuits is crucial to its success, growth, and financial well-being. You can get a policy with lifetime benefits but this will cost more. This is the amount you must pay each year before your insurance company will begin paying claims. Before shopping for home insurance, determine the types and amounts of coverage you need. Look for companies that can provide the levels of standard and optional coverages required for your property.

I’ve conducted research on factors to consider when calculating coverage, and I’ve compared standard coverage from several insurance companies. This site is not maintained by or affiliated with the federal government's Health Insurance Marketplace website or any state government health insurance marketplace. If you have health conditions that require ongoing medical care or need benefits for pregnancy and childbirth, then an ACA plan may best suit your needs. Whether you are without health insurance due to job loss, aging off a parent’s plan, early retirement, or other circumstances, there’s an option available to you.

Those who qualify for their state’s Medicaid program may receive low-cost or no-cost health care coverage. Benefits are defined by each state, but they must meet federal guidelines. Do you earn too little to qualify for an Obamacare subsidy? These plans are designed to provide the broadest coverage, so their premiums will usually be higher than short-term plan premiums unless you qualify for a premium tax credit. Reach out to your agent or insurance company before making expensive changes to your home. They can clarify your policy’s current limits and advise whether you might need to adjust your coverage.

Premium costs are important to most homeowners, so get quotes from several insurance companies. Also compare each provider's discounts, which can sometimes substantially reduce your rate. The North Carolina Department of Insurance recommends carrying dwelling coverage equal to at least 80% of the replacement cost.

Unless you’ve recently taken stock of your home and belongings, given the rising cost of almost everything, there’s a good chance that you’re underinsured. And that could be disastrous in the event of what Clark calls a major “oops” in life. If you wanted to bump your other structures coverage from $30,000 to $35,000, you would need to increase your dwelling coverage to $350,000. Most insurers have a coverage limit for medical payments between $1,000-$5,000 per claim. If you aren’t able to use your home or sections of your home due to damages, loss of use coverage will pay for you to live elsewhere while repairs are being made. To determine the average cost of construction per square foot of a new home based on your location, I recommend using an online construction calculator.

Additional Expenses

They may also ask about the pets you have at home, such as dogs and cats? Insurance agents determine your home’s current condition and how much it will cost to repair or rebuild your house due to a covered loss. Don't be surprised if an insurance agent asks about your home's previous renovations and repairs. Have you or the previous homeowner done major renovations on your home? If you are not sure about past renovations and work on your home, an agent may be able to get this information by asking for local building permits for your property.

Many insurance companies recommend policyholders to create a detailed inventory of everything they own to more accurately estimate your coverage needs. Personal property includes anything you own that is inside your home and is not part of the structure itself, such as furniture, appliances, clothing, and instruments. Standard homeowners insurance policies typically provide medical payment coverage for minor medical expenses. This coverage can be used when someone is injured on your property. Short-term health insurance provides temporary benefits quickly, if you qualify.

No comments:

Post a Comment